27 juin 2018

Performance du capital-investissement à fin 2017

- Performance de 9,7 % net par an depuis 1987 (30 ans)

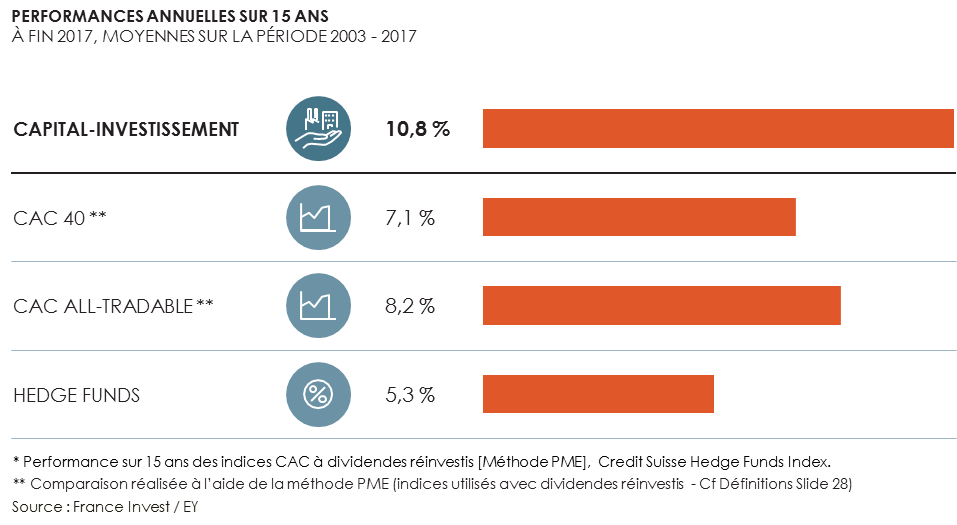

- Supérieure à toutes les autres classes d’actifs sur 15 ans

France Invest (Association des Investisseurs pour la Croissance) et EY présentent aujourd’hui la 24ème édition, à fin 2017, de leur étude annuelle sur la performance nette des acteurs français du capital-investissement.

« Cette année à nouveau la performance du capital-investissement montre la solidité de la classe d’actifs. L’investissement et l’implication des membres de France Invest dans les entreprises non cotées accroît leur valeur. Ceci au bénéfice des investisseurs privés et institutionnels qui ont alloué de l’épargne vers le capital-investissement, et des chefs d’entreprises co-actionnaires. Mon ambition est de convaincre encore plus de chefs d’entreprises familiales du bénéfice d’avoir un actionnaire professionnel à leurs côtés. », déclare Dominique Gaillard, Président de France Invest.

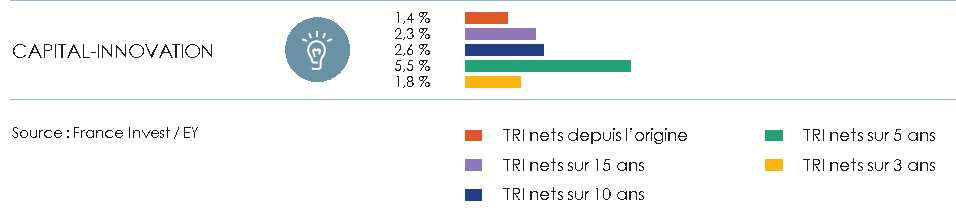

« Les professionnels du capital-investissement sont de plus en plus actifs dans l’accompagnement et le suivi des entreprises non cotées dans lesquelles ils investissent. C’est notamment cette implication auprès des dirigeants qui explique le maintien des performances élevées à 15 ans (10,8 %) sur l’ensemble du métier. Cette contribution à la création de valeur restera un enjeu important, plus particulièrement en capital transmission, dans un contexte où les multiples payés sont tirés vers le haut. À son niveau de performance actuel, le capital-investissement français confirme sa surperformance par rapport aux autres grandes classes d’actifs, en particulier par rapport au marché boursier. Un autre sujet de satisfaction est la bonne performance et la bonne orientation de la performance du capital innovation (5,5 % à horizon 5 ans). Sur ces dernières années, on constate que les professionnels du segment ont su construire le modèle d’un capital innovation à la française. » détaille Hervé Jauffret, Associé EY.

Maintien de la très bonne performance à long terme et surperformance

Sur un horizon de 30 ans, la performance globale du capital-investissement français mesurée à fin 2017 s’élève à 9,7 % en moyenne par an, nette de frais. Elle atteint 10,8 % sur un horizon de 15 ans.

L’investissement dans les entreprises non cotées accompagnées par les acteurs français du capital-investissement confirme à nouveau à fin 2017 et sur le long terme sa très bonne rentabilité et sa surperformance par rapport aux autres grandes classes d’actifs.

Performances par segments

La performance du capital-investissement français est variable selon les segments et croît en moyenne selon le niveau de maturité des entreprises accompagnées.

La performance du capital-innovation qui accompagne des start-up et de jeunes entreprises à forte dominante innovation est à nouveau positive sur tous les horizons de temps. A fin 2017, de 1,4 % par an depuis l’origine la performance atteint jusqu’à 5,5 % par an sur 5 ans.

Les performances du capital-développement et du capital-transmission restent très soutenues. A fin 2017, depuis l’origine, elles sont respectivement de 7,1 % et de 13,6 %.